Non-payment of salary by the end of the month is what every worker fears. Unfortunately, non-payment of wages is still regularly reported to the appropriate authorities. It should be noted that non-payment of salary (wages) has become a criminal offense since 2013. However, many workers do not know what to do in case of non-payment of wages and to whom to report the employer.

Don’t work at a job that doesn’t pay you. Our AI expert will recommend the best jobs for you!

Non-payment of salary – a criminal offense

As already mentioned, non-payment of wages became a criminal offense in the Republic of Croatia in 2013. For non-payment of wages, the employer can be fined up to 13,274 euros and the Croatian Penal Code, specifically Article 132, stipulates that the employer can be imprisoned for up to 3 years.

The criminal offense of non-payment of salary (wages) includes:

- non-payment of wages, i.e. part or all of the wages to one or more workers

- not providing data or providing incorrect data for salary determination (which is why the salary is not paid or partially paid)

Failure to pay wages is a criminal offense if it is intentional, that is, it can be established that the employer is avoiding payment of salary.

Non-payment of salary is not a criminal offense if it occurred due to justified reasons such as an unintentional lack of financial resources on the employer’s account or the inability to dispose of financial resources on the employer’s account.

Intentional non-payment of salary implies that the employer has obtained material benefit for himself or other persons. Also, this includes unscrupulous or disorderly business or management.

Non-payment of salary – to whom to report

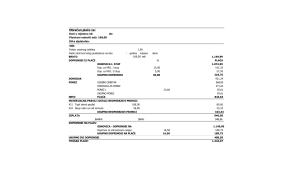

As we mentioned in our guide to payrolls, the payslip or payroll is the basis for the forced collection of claims.

An employer who does not pay the salary by the fifteenth day of the month after the month for which the salary is paid is obliged to provide the employee with a calculation of the entire amount that he was obliged to pay by the end of the month in which the payment of the salary, salary compensation or severance pay was due.

Such a document is considered an enforceable document and allows the employee to collect his claims from the employer in the forced debt collection procedure.

For the employee to have proof that the employer refuses to issue a salary statement, it is a good recommendation to request a payslip and related documents from the employer in writing (by registered mail), referring to paragraph 2, article 139 of the Croatian Labor Law.

Non-payment of wages can be reported to many institutions, and it is much more important to note that employees can directly file a claim for forced collection.

FINA – non-payment of wages

The request for forced collection is submitted to the Financial Agency (FINA), where it is necessary to enclose the payslip of the owed or unpaid salary.

Croatian State Inspectorate – non-payment of wages

If the employer has not provided the employee with a calculation of unpaid wages, i.e. the payroll is unavailable to the employee, the employer should be reported to the Croatian State Inspectorate.

In the report, it is necessary to provide information about the employer (name of the employer and its address), and personal information of the worker (name and surname, address and contact information such as email or phone number).

The worker will then be contacted by the labor inspector for possible additional information or to inform the worker about the results of the inspection. The state inspectorate will punish the employer who refuses to issue a salary statement or certify the payslip properly.

Croatian police and state attorney’s office – non-payment of salaries

As mentioned earlier, non-payment of wages is a criminal offense (Article 132 of the Croatian Penal Code), and workers can also file a criminal complaint with the police or the police officer responsible for the area where the crime was committed (company headquarters) or the proper state attorney.

Croatian court – non-payment of wages

It is important to note that without a valid payslip, the salary can only be collected by initiating court proceedings.

Many workers do not decide to hire a lawyer because they do not have the money for one precisely because of non-payment of wages. However, if they are in a bad financial situation or will find themselves in one due to non-payment of wages, they can seek free legal assistance from state administrative bodies or authorized associations and legal clinics.

Croatian Workers’ Claims Insurance Agency

If the employer is bankrupt or their account is blocked, workers can turn to the Croatian Workers’ Claims Insurance Agency for help, which offers on its website prepared forms for starting the forced collection procedure, i.e. the payment of wages (wage compensation) up to the amount of the minimum wage.

Non-payment of salary – FINA

As mentioned earlier, workers who have not been paid their salary can submit a request for forced collection to Croatian FINA, for which a valid (certified) salary statement is necessary.

Requests for forced collection of unpaid wages in case of bankruptcy of the employer are urgent and have priority, and will be collected before other received enforcements. More precisely, they are collected before all other enforcements except those for other unpaid wages and enforcements for the collection of child support.

Interestingly, an employer who does not pay an employee’s salary for the previous month by the last day of the month is obliged to submit to FINA on the first following working day a request for compulsory collection along with the payslip of the unpaid salary.

The Croatian Tax Administration is obliged to notify the Croatian Labor Inspectorate every month about employers who have not paid their salary in the previous month. If the employer has not submitted a request for the payment of the unpaid salary, the Labor Inspectorate issues a decision on temporary payment security, which is submitted to the Croatian Financial Agency.

For collection purposes, FINA seizes the funds in the employer’s accounts, and if there are not enough funds in the accounts to collect the claims, FINA issues an order to the employer’s banks to block all the employer’s accounts.

Non-payment of salary – bankruptcy of the employer

Blocking the employer’s account is not the only solution for collecting unpaid wages and benefits. According to the Croatian Bankruptcy Law, after 120 days of account blocking, FINA will submit a proposal to open bankruptcy proceedings against the employer.

The court issues a decision on the opening of bankruptcy and schedules an examination hearing where non-payment of wages and workers’ claims will be determined. The bankruptcy may be concluded at the first hearing, and additional hearings may be required depending on the type and severity of the bankruptcy proceedings.

Workers, if they have not already submitted a request for payment of wages, can contact the above-mentioned Croatian Agency for the Insurance of Workers’ Claims in this case.

It is important to note that the deadline for initiating proceedings before the Agency is 30 days from the publication of the decision on established claims (which is published on the courts’ e-Notice board) or from the conclusion of the bankruptcy decision.

The request is submitted in person or by postal delivery to the Croatian Workers’ Claims Insurance Agency, Croatian citizens can use the application on the Agency’s website, i.e. e-Građani, or through the Croatian Employment Service.

According to the Croatian Workers’ Claims Insurance Act, in the event of opening bankruptcy proceedings, workers have the right to payment of:

- unpaid wages or salary benefits, amounting up to minimum wage for each month of the protected period

- unpaid sick pay benefits in the protected period up to amounting up to minimum wage for each month spent on sick leave

- unpaid benefits for unused annual leave to which the employee acquired the right until the initiation of bankruptcy proceedings amounting up of the minimum wage

- severance pay amounting to half of the severance pay determined in the bankruptcy proceedings

- compensation for damages due to an injury sustained at work or occupational disease amounting up to one-third of the legally awarded compensation for damages

Among the workers who have the right to the payment of unpaid wages and benefits in case of bankruptcy are included

- workers who were employed by the employer at the time the bankruptcy proceedings were initiated

- workers whose employment with the employer ended within twelve months before the initiation of bankruptcy proceedings.

The protected period in the bankruptcy procedure is the name for the period during which the protection of workers’ rights is carried out. It lasts for the last five months before the opening of bankruptcy proceedings against the employer or, in the case of employees whose employment has ended twelve months before the opening of bankruptcy proceedings, five months before the termination of employment.

Non-payment of wages – statute of limitations

The statute of limitations in case of non-payment of wages begins on the first day from which the worker had the right to demand forced payment of wages. So, as mentioned, it is the first day of the month after the end of the month in which the salary payment was due.

The statute of limitations for claims arising from non-payment of wages is five years from the due date (Article 139 of the Croatian Labor Law), and this period used to be three years.

The statute of limitations is terminated by:

- acknowledgment of debt by the debtor

- statement

- repayment

- payment of interest

- providing insurance

- by filing a lawsuit or forced collection procedure before the court, Croatian Financial Agency (FINA), or another competent body

Non-payment of wages – workers’ rights

Of course, the main right of the worker in the case of non-payment of wages is to initiate proceedings for forced collection or enforcement. At the same time, the worker does not have the obligation to first file an official complaint with the employer but can start the procedure without it.

Workers who have not been paid their wages become creditors of the employer, and he becomes their debtor.

In the case of non-payment of wages, judicial practice has shown that the worker has the right to refuse to work until the wages are paid, and in such a case refusal to work cannot be a reason for termination or cancellation of the employment contract.

Namely, non-payment of wages means that the employer has stopped fulfilling his contractual obligations from the employment contract, so the worker is no longer obliged to fulfill his contractual obligations until the employer pays the wages.

On the other hand, due to non-payment of wages, the worker has a justified reason for giving extraordinary notice of the employment contract. It is important to note here that the worker after such termination has the right to unemployment compensation because such extraordinary termination of employment is considered the termination of the employment contract through no fault of the worker.

Conclusion – non-payment of wages

Non-payment of wages is a case that is regulated in multiple ways in the Republic of Croatia through several institutions, and it must not be forgotten that it is also a serious criminal offense.

In the case of non-payment of wages, FINA forcibly collects with a valid payroll (or pay slip). In case of bankruptcy, the Croatian Workers’ Claims Insurance Agency ensures the collection of part of the amount owed to the injured workers even with its funds.

The employer who is late with salary does not deserve you! Check what others offer to you!